The Coronavirus infections have been increasing at an extraordinary rate. On Jan 22 there were 580 known infections. On Feb 24, over 80,000.

97% of infections (at least) thus far have come from China. Therefore 97% of the data we have also comes from the Chinese government. Given China’s lack of transparency, people feel very cautious to extrapolating much from that data.

Looking at the 3% of infections outside of China, Korea and the cruise ship represent the majority of that problem. So 98% of the problem is currently in 2 countries (and a cruise ship).

Of all the closed cases that have a definite, known outcome (ie, they fully recovered or died), there is a 91% recovery rate vs 9% death rate.

The Chinese CDC states the virus impacts older people substantially more. This fits with common sense and most illnesses.

Preliminary conclusion: it appears if you contract the virus, and if you’re less than 60 years old, odds are probably 95-98% you’ll recover. The odds are likely even better if you don’t have any other substantial health related issues.

The real issue is that no one wants to trust their life to Chinese government statistics. However, with the increase in infections outside of China, soon will we have a lot of believable data.

Counter-point: Here’s a table of all other infected countries’ data. I *highly recommend* looking at it for 2 minutes.

A couple stand out observations. If you do some quick math, new infections in some countries outside of China are rising by 5-30% per day.

If you look at total cases then look at deaths and recovereds, you get a sense of likely ratios (and that Iran is probably hiding/under-reporting, which they are being criticized for).

The clearest and probably most important standout is the huge number of infected but not recovered or dead. This shows the very high degree of unknown outcomes. For example, in Korea, with nearly 900 cases, only 30 have known outcomes (9 deaths, 21 cleared). That means we don’t know the outcome yet of 97% of those infected. Currently, that’s also a nearly 33% death to recovered rate (much higher than China’s reported 9% rate).

With the hockey stick shaped rise in new infections outside of China, and with people being sick for 2-3 weeks, we probably just entered a window that will last 3 weeks where we will gain a much higher degree of confidence in how deadly (or not) the virus is; and its potential for a high number of deaths if it becomes a pandemic.

But it’s too early to say much with confidence. And that is exactly the risk at this point: so many unknowns with a virus that is spreading rapidly.

Solution: While this may be a black swan event, if the problem does significantly come to the US, what solves 80+% of the problem with 20-% of or less of the effort? The key is to prevent contact, which means staying away from high risk public places. Which means already having food and water and a way to cook the food for a long enough period of time.

Without getting too crazy, 80% of supplies probably look like:

- medications

- 15-30 days of food & water (Costco is cheapest per gallon of water; focus on buying a variety of food you know you’ll eat anyways that keeps/stores for longer periods of time. Also freeze dried food is very tasty and keeps 8-25 years)

- propane tank(s) & single burner stove for propane

- N95 masks, disposable gloves, goggles, hand sanitizer, disinfectant wipes

- body wipes, toiletries (soap, TP, toothpaste), masks for children are different than masks for adults, and

- Pet food issues.

Understand that by the time an item is needed, everyone else realizes this, too (for example, N95 masks). In a crisis, preparation must happen early, before it’s needed.

When looking at this list you realize, if you buy food you’re likely to eat, the net cost of being prepared early is quite low.

Key Realization: the odds of losing water/power more than 7 days baring fire/mother nature/war are really low. Once you get past 14 days, then you’ll likely have another set of social complications/issues, like rioting. Or attacking the helpfully labeled Mormon Foodhouse Storage. 😉

However, this is small tail analysis: rioting is likely in densely populated areas, stores are what get hit (much less houses). The remaining 20% is probably built around a generator, gas, gun/ammo, water purifier, etc. Something to be explored later after the (80%) first level has already been solved.

Thanks to Craig for soundboarding this analysis with me and for Elliot for providing the link to this site (there’s a lot of noise out there).

As always, I welcome all data or analysis, confirming or to the contrary.

* * *

Lastly: I think one of the greatest risks could be to the supply chain. So many of the parts needs to make anything, even US built cars, comes from China. Hard to build a car when you’re missing even a few parts from China. How many of the basic things we need and make in the US are dependent on China-made products. Even our phara grade meds are mostly out-sourced to China. Since the country worst hit is also the world’s greatest supply chain supplier, there’s real risk that’s begun hitting US companies like Amazon and Apple. Which again means, lots of unknowns.

I started Crossfit about 6 months ago. Here’s what “Me Now” would tell “Me Then” – but since I can’t, here’s my suggestions to help you. This is the short-cut list:

Frequency: Slow is fast when starting. Start out 3x a week, build a base, and advance to 5+ workouts a week. It’s easy to get intense and overdo it in the beginning. I had to dial back. Even if you’ve been a gym rat for years. Good at bench press? Cool, bro. Can you run like a bear, row 1000m, pull a sled, and do 30 double unders for 5 rounds, for time, next to someone you thought for sure you were faster than who’s kicking your ass? Say after me: Crossfit is different. Build the unused ancillary muscles, and pretty soon that warm up that killed you will be actually feel like a warmup – and you’ll be (safely) rocking 5+ workouts a week and wanting more.

Frequency: Slow is fast when starting. Start out 3x a week, build a base, and advance to 5+ workouts a week. It’s easy to get intense and overdo it in the beginning. I had to dial back. Even if you’ve been a gym rat for years. Good at bench press? Cool, bro. Can you run like a bear, row 1000m, pull a sled, and do 30 double unders for 5 rounds, for time, next to someone you thought for sure you were faster than who’s kicking your ass? Say after me: Crossfit is different. Build the unused ancillary muscles, and pretty soon that warm up that killed you will be actually feel like a warmup – and you’ll be (safely) rocking 5+ workouts a week and wanting more.

Social: Make friends, talk shit, have fun. One of the *top* reasons crossfit is so successful is the sense of community. And this is coming from someone who mostly works alone, has always worked out alone, and generally did solo sports in school. The community / relationships increase how often you go, it improves your intensity while you’re there, increases the fun – and all of this increases results. Which makes you want to do it more. If you choose to isolate yourself in this environment you’re a fucking idiot.

Coaches: In my business experience, lots of “coaches” get paid well to talk good game but don’t know much. I was cautiously skeptical of crossfit coaching advice. It took me a bit (read: loooong bit) to fully appreciate how much crossfit coaches know. That interesting question you just thought of? They’ve thought about it from 6 angles, experimented with it maybe a year or two, and can give you all their experience – for free, in minutes. For the love of God, take it. Life is too short to do things the hard way. Ask questions. If something doesn’t feel right, ask. Form? Attack strategy? Diet? Gear? Ask ask ask. And then ask.

Equipment: Seems eventually everyone generally ends up with core “crossfit” equipment. For a reason: generally, the sooner you get it, the more you’ll enjoy life (roughly in order of importance).

Shin guards: The first time you avoid hitting your shins on a box and don’t end up leaving chunks of your skin all over that box, buy me dinner. I was recommended and love Rock Guards. They also help with deadlifts (keep the bar close to body and avoid dragging the bar up your shins).

Notebook: The first thing I bought was what I felt was an overpriced exercise tracking notebook sold at the gym. And it was worth it. It gives you a record of each days’ workouts, weights, times, maxes, notes to yourself for next time. If you’re going to invest the time and money and energy in crossfit, for heaven’s sake get a notebook.

Shoes: Seems like everyone ends up with one of 3 shoes: No Bull, Nike Metcons, or Rebook Nanos. Coach told me to buy all three, put them on at home, try air squats, and see which one naturally feel right, return the others. On point advice. The ones most people like (Nanos) didn’t fit right, but Metcons I instantly loved. You really feel a difference in squats and deadlifts and general stability with crossfit-specific shoes.

Jump Rope: I finally decided I wanted to stop sucking at double unders and whipping myself. This is hard to do without a good jump rope. After spending over $100 trying different jope ropes (lengths and weights), my favorite ended up being this inexpensive $20 adjustable version from amazon.

Foam roller: The thing you love to hate. If it didn’t work so damn well you’d never use it because it hurts so damn bad. It helps with recover and flexibility and muscle health, which reduces injury and increases performance. I got two sizes (one for travel and one for home).

Optional/Misc: The 5″ rolling ball, Hookgrip tape.

That’s it. Short and simple. The things I now know, I wish I’d known sooner.

I recently bought a first class ticket from Washington to London for free with Delta SkyMiles. Here’s how:

The Basics:

There are a number of things that make no rational sense when it comes to buying tickets with SkyMiles. Most people don’t realize that and that’s what we’re going to exploit.

In theory, a mile should be worth approximately $.01 – so a $250 ticket should cost 25k Skymiles. And that is in fact the pattern most of the time. The trick is, sometimes it is NOT. Sometimes it’s REALLY not.

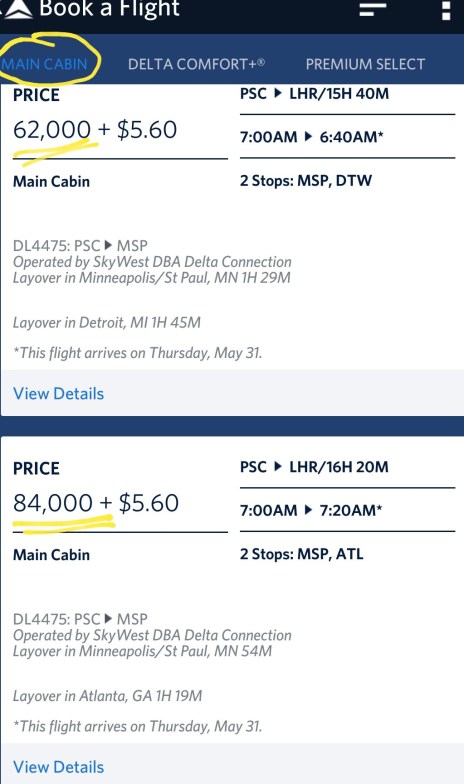

Here’s an example of what a one way main cabin ticket to London costs with miles:

Here’s what a first class ticket costs with cash:

It’s usually $4,200-$7,000. Insane.

But get this. When you look at flights the same day, you can find a *first class* DeltaOne ticket (the best ticket you can get, with seats that lay down flat into beds, etc) using miles:

Wait. Reality check. You can buy a first class $7000 ticket for 70k ($700) worth of miles. But you could buy a main cabin ticket for 84k miles? Yup. Logical? Hell no. Awesome? YES! It can be cheaper to buy first class than main cabin on the same day. Miles can be used to discount a first class ticket up to 90% off? Yup. I purchased my ticket for 87k miles based on the specific day I needed. Still crazy.

THAT is how I flew first class to London for free using miles. Exploiting crazy patterns in Delta Skymiles. There are wild inefficiencies in their system that if you’re aware they exist can make for Iggy-level fancy travel. For less money than main cabin. Which is insanely awesome.

Quick international travel hack:

Lounges: I’m writing this while sitting in one of the top UK lounges getting ready to fly out. Free food, internet, tables to work from, and peaceful space. Using the Amex card, you get a Priority Pass card which gives you access to all kinds of lounges when you travel around the world for free. It really does make travel a lot nicer.

Packing list: Sometimes it’s remembering the small things that make travel easier. Here’s a link to a packing list I use (and keep updating).

Travel even better: Here’s a link to a travel article about using 125k Amex miles to travel around the world in business class.

The stock market is on a 7+ year tear & real estate prices are exploding. The contrarian investor in me sees some red flags popping up.

The stock market is on a 7+ year tear & real estate prices are exploding. The contrarian investor in me sees some red flags popping up.

Red flags are what I look for that say shit might hit the fan.

Examples of flags:

- Unsophisticated Involvement: Is everyone at the family reunion talking about stocks and options (2000), or getting into real estate (2005-2007) or Bitcoin (2017-2018)? When people are investing in something they often think they understand but really know nothing about, there’s often a huge transfer of wealth coming up.

- Debt/Credit levels: How leveraged up are people, particularly the least sophisticated people? I tend to think debt can be positive and useful, but too much is toxic and dangerous. Keep your radar open for news articles on auto debt, household debt, student debt, credit card debt, home equity loans, etc. When everyone is maxed, the room for error went to zero.

- Debt/Credit criteria: For banks to create more loans, as a market cycle gets later, loan criteria will progressively worsen. Lower credit scores, less money down, less qualified people for larger amounts. It used to be put 10% down on real estate then 5%, then 3% now over ask price, no money down and raise the price to wrap in closing costs.

- Explosive pricing: At the end of most “bubbles” are often a ramp up in price in a short period of time. In a weird (but understandable) way, the huge price run up confirms the mental story the public has bought. Dot-com will change the world, buy any house and it’ll be up 25-30% in months because that’s what it keeps doing; Bitcoin will change the world and look, it’s up 1,900%. In a year. Again. And the run up confirms peoples’ story/”logic.”

- Fear of missing out: Watch for when people stop being afraid of risk and what could go wrong and are only afraid of missing out on the profits. When “nothing can go wrong,” that’s when it usually does.

- Everyone is an expert: When people who a year or two ago knew literally nothing about an area, but are now telling everyone around them the secrets of getting rich… that’s a flag. There will be tons of books telling you how to get rich in this area.

- Rich, on paper: These same speculators don’t have money in the bank. Those stock market riches, or the highly leveraged real estate millionaires, or turning $10k in BTC into $250k in a year – people who mostly made money doing nothing but sitting— unless they cash out, it’s all “paper wealth.” And those same people that got lucky rich from being involved in a market run up… won’t sell. That’s how they got rich in the first place. Doing nothing. Not selling. So they ride it up, then ride it back down.

- Media coverage: When all the websites, when all the “experts,” when all the media channels are pontificating about on a single “investment” (that they weren’t covering two years ago), that’s a flag. Remember all the TV shows about flipping? Right before the market crashed? And then when it was the best time to buy, no TV shows. It’s a flag/counter-flag.

In late 2017/early 2018, in Bitcoin, I see MOST to ALL of these flags. I see huge levels of unsophisticated people putting money they can’t afford to lose, often borrowing money, to “invest” in BTC. Pricing has been textbook bubble (literally, I expect to read about it in future textbooks). Everyone is baller rich – on paper. Most of that wealth was created in a very short period of time. Lastly, I was in Vegas for a best friend’s birthday and everyone was talking about different cryptocurrencies and crypto theories. I turned to my buddy and said, “Notice what everyone is talking about at this party. Remember this moment.” That was January 11th, 2018 (2 weeks after the market peaked). That said, if it goes from $20k to a million a BTC, this article will be proof I was wrong.

Counter flags. When it comes to flags, it’s also useful to be aware of the opposite, of “counter flags.” Limited media coverage, the public deathly afraid of an area (like stocks in 2001, or real estate in 2009). The general public “experts” are now quiet (and often broke). No one sees profits – everyone sees risk and downside. Blood in the streets. Etc. Those counter flags often encourage a different set of actions.

Truth is, at any moment, the current environment in an investing area is often a mix of flags (ie, not all of them are up on one side). So there’s what I like to call, “lean.”

Lean is how aggressively you lean into the the investment. When something is good, you lean forward in your seat. When it’s not so good, not so interesting, you lean away. Think of it as a continuum from 1 (lean waaaay back) to 10 (lean in, hard). Easy to write, emotionally much harder to do in practice, especially to be contrarian when everyone is hopped up on how good something is.

Example in my own life: In 2004-early 2007, I was leaning hard into real estate. Then I saw realized I was seeing flags everywhere (all the above) and sold my real estate. All of it. After the market crashed in 2008/2009, I leaned in. HARD. Like a 10. I’ve stayed leaning in at a level 7.5-10 for years.

However, in the last couple months I’ve shifted my lean. I’ve cut my debt levels 85% from their peak. Right now my lean is more like a 3.5-4. That’s a huge shift of a lot of money and risk adjustment.

Truth is, I’d like to have a few more properties, but I can’t find many deals that make sense. I’ve become a lot more careful. I’m still in the game, but I’m leaning back more and more.

Calling perfect market tops is a fool’s errand. But it’s a worthwhile endeavour to analyze when it makes sense to lean into a situation and when it makes sense to lean back. It makes a huge difference in managing risk and maintaining wealth over a long period of time.

The present environment: The US stock market is on its second longest, second biggest bull market in history, and greatest run depending on if you’re comparing the Dow or S&P. That should scare the shit out of investors since markets always reverts to the mean. The real estate market has been on an explosive tear in the last 3-ish years and especially the last year. In many cities, buyers are often offering 10-15% over ask price, just to try to win! I’ve seen prices jump 5-10% … in a MONTH. (Imagine if I was telling you that was the likely future 4 years ago…) As a point of reference, the average appreciation of real estate is 3%. That’s 3 years of appreciation – in a month.

In my humble opinion, after that kind of run up, it’s definitely not time to lean in hard or double down. Lots (but not all) flags are up. In my opinion, it’s a time to shift and start to lean back.

Summary: if you want to be a contrarian, long-term investor, look at “flags” and adjust your “lean” accordingly. As a cycle progresses, you’ll see more and more flags pop up. When that happens, consider shifting how you’re leaning with your investing. When everyone is doing a thing, think strongly about doing the opposite. Presently, I’m shifting from leaning in hard to leaning back, de-levering, and being cautious.

More advanced thoughts/flags: In real estate, there are definitely flags I’m not seeing – like stupid horrible lending standards, taxi drivers buying 5 homes on stated income loans, everyone talking real estate at parties/reunions, the general public trying to retire overnight by flipping, etc. In short, I’m not seeing the levels of ridiculous that indicate a huge bubble. That said, I’ve seen a lot of run up, definitely more looseness in the lending side, all the fear is on scarcity – not getting a deal vs is it a good deal (a la, huge run up). And I see people making money by doing nothing other than waiting 4-5 months and before they can finish a remodel the market has gone up a bunch. There have been bubbles in stocks (2000) and real estate (2007). I don’t tend to see that kind of crazy bubble in either now. But I do think we are due for a pretty decent pullback overall in both as part of the cycle of rising (and falling) around the average. Real estate is a very non-linear business. There’s a time to slam hard and make money, and a time to chill more. I’m starting to see this as more the latter.

In January of this year, I got serious about trying to hack airline travel. In the past, I just hadn’t traveled enough to warrant putting much energy into it. Plus, since 9/11 air travel had become a PITA. This year, I decided to play the game.

In January of this year, I got serious about trying to hack airline travel. In the past, I just hadn’t traveled enough to warrant putting much energy into it. Plus, since 9/11 air travel had become a PITA. This year, I decided to play the game.

Now: skip past lines, relax in amazing lounges, get upgrades to first class, and get free flights. It completely changes the experience of travel.

Where to start: Choose an airline. I chose Delta because it’s one of the top rated airlines (vs United), has the best lounges (by far), and covered the US well (which I wanted). Hopping from airline to airline is something infrequent travelers do. Smart semi-frequent travelers choose an airline and stick with them. It’s worth it.

Next: Get a credit card that allow you to blow up your status rapidly. For Delta, I got the Platinum Skymiles card – one of the only ways left to pump status without actually flying. 10k miles for signing up at the airport. Then I started running my expenses through it. At $25k in expenses I get 10k in qualifying miles – and at that stage, you’re at a total of 20k status miles – which is only 5k miles away from Silver status, where the free upgrades kick in. Just off this card alone you can bump an extra status level, plus – a big deal if you consider how many flights that takes. The spending miles count towards free flights and there are other accelerated perks (look into a comparison of the different cards). When it comes to annual fees, focus on the net cost. The fee is $195 a year, but comes with a free companion ticket (worth more than $195 to me).

Next: Consider the American Express Platinum card. Buckle up and brace yourself. The annual fee is $550. But, again, net cost, grasshopper. It offers an airline credit of $200, pays for Global entry (which also gets access to the TSA Pre-check line) $100, and offers $200 a year in Uber credit and other Uber perks (VIP, discounts, etc). There are restrictions, so read the details. For me, the first year cost quickly looks like $50 net-ish. But the signup bonus is usually 60,000 points (~$600), so essentially the two years are free. No brainer in my book. Even a minimal amount of annual travel makes this card worth it. While this card gets you into the famous Centurion lounges, the real perk is getting into Delta lounges for FREE (usually it’s $29-59 per use, and on one long round trip flight I’ll often use 6-8 different clubs).

Next: find the best lounges to relax in. Normal lounges are getting over-run. Delta’s lounges are massively upgraded and have restricted access. They’ve totally changed how I feel about travel. They are head and shoulders above other lounges – often with quality, local chef-created food, free alcoholic drinks, free (good) coffee, spacious, uncrowded, space — basically this quiet haven away from the loud craziness that makes travel a frazzeled experience. It’s a game changer. And with the right credit card, it’s free.

Clear: In some airports, TSA pre-check has started to get overrun, too. Clear gets you escorted to the front of the security line and skip the 5-10 min TSA line and the 15-90 minute normal lines. And if you know someone who has Clear, it’s only $50 a year right now. It just totally eliminates lines – which makes me feel so much calmer.

Noise-canceling headphones: I have bought and tested a variety of types on flights (not just in the store). I highly recommend the Bose Q25. The Q25’s have better noise canceling than the “newer” Q35’s. This is one of my top purchases in 2016. If you’d like bluetooth (which I also recommend), buy the separate add-on here. Couldn’t understate how much eliminating all that noise changes the feel in your body of travel.

Wifi: Gogo in-flight wifi often costs $8-$20 per flight. If you fly frequently that crap adds up. I buy packages of 12 off ebay for less than $5 each.

Summary: I used to hate travel. Having to get there so early to get in the line to check my luggage, then get in the line to get through security. Sitting in a crowded zoo of a waiting area. Waiting in a line to get on the plane to compete for a space to put my carryon. Sitting in an uncomfortable, cramped seat. It’s no wonder I avoided air travel.

Now, I skip the long luggage line, then skip the security line and head to a lounge. I’ve timed it: at SeaTac, from stepping out of the Uber to walking into the amazing Delta lounge is ~7 minutes. Cue quality food, coffee, and drinks in a quiet space – for free. I skip the boarding lines and walk on the plane, get settled into much more comfortable First class or Comfort+ seat – which I got for free, and relax. After landing, I am off the plane super fast and walk right to another amazing, relaxing lounge. It’s feels like a totally different experience.

And most of it came from optimizing the game.

[Credit: Special thanks to other travel ninjas who taught me despite my sassiness. Heidi for sharing the AmEx Platinum card benefits after I made fun of her for having a card with a ridiculous annual fee (you were right, net cost and benefits) and Koichi for hounding me to get Clear (also, right)]

For a really long time, I’ve wanted to operate my businesses remotely and explore living in another city… somewhere around the world.

Except I couldn’t’ figure out how to crack the code until, I think, tonight I stumbled on it in waves.

I met a feisty Australian lady named Sheryn. She lives in Bali, she runs a ridiculously gorgeous B&B I stayed at for $50/night. See pictures to see what I mean about ridiculous.

We got to talking and she told me about her blog. Then she took and friend and I out to dinner and introduced me to her ex-pat friends. It felt like hanging out with 60 year olds who talked, joked, and sassed like 35 year olds. It was fun! Apparently in Bali/Indo, there are 150,000 ex-pats living here. 150k! Like a buffet of cool people to meet.

Tonight I read her blog. It was amazing! Extremely eye opening as someone with questions about living here:

Need a good masseur? Need a hair dresser? A mechanic? Where to do laundry? Or buy organic X/Y/Z? Good inexpensive alcohol (impossible to find)? Fake driver’s license? Medical. Dental. Taxi’s. Pet-sitting. Tour guides. Best ice cream, fish, meat, you name it. Plumber? Tailor?

Basically, it got clear: what you need is one Sheryn in each city you’re interested in. Someone who spent a year or two figuring everything out, and who can brain dump it for you- Blah, after all my struggles and failures here, this is everything I know that’s best.

And what dinner showed me every Sheryn knows a ton of other ex-pats who have ex-pat friends… who have more ex-pat friends of friends. This vast network of very dialed in world travelers.

I got to thinking. I’m betting that with this one launch point, I could successfully meet someone who could introduce me to my own Sheryn for another city, say, BA. With her knowledge, I’d be wired and hit the ground running like – like a professional local.

I want the compressed knowledge of someone who is living in the city – best places to rent, fair pricing, best times to visit. What they love, what they hate.

Know what it costs labor only to hire a full time personal chef in Bali? $250-$300 A MONTH. What?! I learned what it costs to get a suit hand made from some of the nicest material (where the top suit makers buy their fabrics). What it costs to rent a place for a month in a great area of town. And I learned it all within 2 hours of landing in this city because I had Sheryn as my connection. It’s like a cross between an Amazon Echo and Apple Siri.

Give me 3-4 Sheryns in this city and I could live here as if I’ve been here for years within a week, with a fraction of the energy it normally would take to enjoy that life.

Introduce me to their friends in other cities, and quite possibly, the world just opened up. Not just to visit, but to live truly like a local – cheaper, less stressful, and way more fun.

While we were at dinner, another sassy Australian told me they had a strawberry farm. What they call strawberry farm, turned out to be a multi-home villa in the mountains. Now I have that connection/option.

What does this cost? That’s the crazy thing! With the right connections – you’re going to the best places, with the most fun people, and at the best price! It’s amazing. It’s like pixxy dust.

In summary:

What I needed isn’t to work my ass off to research every city, try to optimize which is best, etc etc (which in my experience is both miserable and fails and makes one want to punch a baby in frustration).

I just need one fun, sassy, communicative, Sheryn in whatever city I am interested in – a person who has figured the best things out in her city, organized their thoughts, and is happy to share. I want to suck her brain dry.

A Sheryn in each town solves all the mechanical aspects of life and is a social launch pad to meet all of her friends, and their connections/experiences all over the world. Then the rest is up to me.

Final

I’m betting that within a month, with Sheryn, all the mechanics of life and the emotionally connecting with other like minded individuals will be solid. Then the question will be, does this foreign city feel like a place I could call home?

And after meeting and talking with all of these ex-pats I’m told are here, the next question will be, what’s the next place that sounds like it might home?

Ideally, maybe develop different homes all over the world.

But first things first, let’s see what making this a home away from home feels like.

Someone recently asked me if “debt was good or bad.” A better question is, “Which types of debt are good, and which types are bad?”

Someone recently asked me if “debt was good or bad.” A better question is, “Which types of debt are good, and which types are bad?”

Consumable debt

This is debt for personal purchases – anything you consume – that is guaranteed to go DOWN in value. These are vacations, TVs, couches, cars, clothes, boats, etc.

Try this as an experiment. Take that $70 sweater, or $3000 couch you bought a year ago and look for what it sells for on Craigslist (or try to sell it to learn). What is it worth? In my experience, when you add in taxes on a new item, the loss is on average 75%-ish. Now imagine financing a 75% losing investment. Financing costs often make make something 50% to 100% more expensive. Now the loss goes to 90%+.

While you’re paying 50%-100% more than the original price, the value does the opposite – going down 75%. It’s one of the best ways, most efficient ways to light money on fire.

Zoom out. Big picture. People put 5k in their Roth IRA for retirement but have a 40k cars/boats/crap/etc that depreciates at 10-15k/year. They feel bewilderment about why they never seem to get ahead. It was mathematically certain when most of the places money is spent decreases in value by 90%.

Here’s the rule. It’s simple. Consumer debt = BAD.

If you can’t pay cash for it, you don’t buy it.

The advanced version of that rule is to not only pay cash, but try to buy all of those items for 50-75% off (to avoid the very thing we just talked about). It’s a skill that once developed makes it almost impossible to pay rack rate for anything. Multiplied over years, this substantially lowers the bar for monthly personal expenses (making it faster/easier to retire) and funnels more money into savings (again, making it faster/easier to retire).

Investment Debt

This is debt used to purchase things that generate INCOME.

Examples of things that generate income: rental properties, businesses, flipping, etc.

Rental Properties: This means property that each month pays the mortgage AND makes you positive cashflow. Keep in mind the higher the debt the higher the risk. Options here include using a 15 year mortgage or taking your time to buy a property 20-50% below market value. If bought right, and in an area likely to have quality tenants, this can be a relatively stable investment. I tend to prefer paying cash for rental properties because I prefer that high level of safety. But a strong argument can be made for using debt to finance the right kinds of investment properties. You just need to be sure you can survive down cycles – real life isn’t a clean, linear excel spreadsheet. No point in having rentals for 7-8 years and then getting busted when the market changes out because you’re overleveraged. That said, I love rentals. I know more people who have become millionaires from real estate/rentals who are “normal” people (not inventing facebook) than from any other way.

Businesses: I have friends who have used debt to buy other people’s businesses and through their management skills to lower costs and raise revenue. The business then throws off enough cash to pay for the business AND generate a chunk of extra money. Not only is the value of the business increasing, it’s throwing off extra money, and in 5-7 years it’s paid off and throwing off a lot of money.

Flipping: I’m a big fan of this approach. It’s the most basic buy low, sell high approach and it can be applied to almost anything from houses to cars to tons of weird stuff that sells online. This is the exact opposite of consumer spending, of buying high and eventually selling low. Instead, you should have already locked in your profit when you buy low. I like using flipping to generate money as an active full time or part time business and then take the profits and use it to buy passive income producing assets. Note the debt associated with flipping is usually very short-term in nature (a couple months tops assuming you’re flipping quick, which is the goal). This is lower risk because it means you don’t have to predict how the market/economy will be doing in 10 years. You only have to have a sense of how things will be in 2-3 months, which is much easier.

The key thing to note is debt is used here to MAKE money. With consumer debt, it’s used – often unknowingly – to LOSE money.

And simply put, that’s why consumer debt is bad, and investment debt (used carefully/wisely) is good. One makes you very poor and a financial prisoner. The other makes you richer and freer.

Advanced. Final note, I have very successful friends who finance their cars/toys instead of paying cash. The difference is WHY they do it. They could pay cash, but if the bank will give them a loan at 3% on the car they want and they then invest it in their businesses / properties / etc and make 20-50%, making them more money. Note the reason they took the debt on was to MAKE more money, not because that was the only way they could afford it.

Advanced #2. Investments debt can be highly leveraged. If you buy a rental house with 5% down and the market goes up 5% you’ve doubled your money (in over simplified terms neglecting selling costs). Great! If the market goes down 5%, you lose 100%. Holy crap! This is why if you’re using leverage that I’m a fan of buying fairly substantially below market value. That way if the market goes down you have space built in when you bought. Otherwise the margin for error depends on hoping the market goes up / nothing goes wrong. In my view, better to be patient and move slow and be safe.

I like to bet money on elections so I can’t afford to be emotional about who I want to win. I only care about who will win. In 2012, I won over $5,400 on political bets.

For the Republican nomination in 2016, I predict Trump will win.

There are a number of unique R-nomination factors when compared to the D nomination process, and ALL of them favor Trump. and give him a disproportionate lead compared to what polls show alone (which is a substantial lead). Because the R nomination is much more complicated than the D process, in 2012, I built a spreadsheet to model the process. You can see the spreadsheet here.

Observations / Conclusions:

- Having more candidates stay in the race longer, especially until March 15th or later, strongly favors Trump.

- There are a number of winner-takes-all states. These all favor Trump.

- There are a number of states with minimum floor requirements, meaning candidates often have to earn 15-20% of the vote to receive any delegates. A number of states have candidates hovering around 10-17%. They may get 0% of the delegates instead. This system strongly favors Trump.

- By March 15th, Trump will likely have more delegates than all of the other candidates combined plus an additional 25-50%.

- By March 15th, 60% of the delegates will be decided. It will be very difficult to candidates who are behind to catch up. This strongly favors Trump.

Karl Rove wrote a WSJ piece outlining that unless some candidates drop out and their supporters rally around a single non-Trump alternative by March 8th, it’s highly unlikely anyone catch Trump. I see no indications that Rubio or Cruz will drop out in time.

On March 15th, Trump will likely be substantially ahead in the delegate count and it will be so late in the process that anyone catching him will be a remote chance at best.

The betting markets reflect that Trump is a favorite to win the R nomination by 75% odds. Interestingly, while Cruz in the #2 candidate in polls with 20%, the markets are putting him at last place with abysmal odds of less than 2%. Rubio has odds of ~17%.

In the presidential contest, I also predict that Trump will lose to Clinton.

Sidenote: While the polling data for the R process isn’t nearly as good as the D side, the delegate projections will have a wider margin of error but conclusion that Trump will be the nominee doesn’t change.

(I wrote this about 5 months ago at the same time as the Clinton prediction – I forgot to hit post)

I predicted back in 2013 Clinton would run. And if she ran she’d be the nominee and subsequently she’d be the next president.

With 6 months to go, I wanted to offer a look at the odds of that prediction being accurate.

The media paints a picture of a close race. BS. They are motivated to do that because it sells advertising and it’s what people want to believe/feel.

When you look at people who’ve built their reputation on predicting elections (not selling ads), you get a different picture. Back in 2012, I used this discrepancy between media/public feeling/perception and pro perception to make 54% on a 10k bet in 3 days.

Prediction Pros. These aren’t talking heads on TV. They’re political data junkies. They don’t just look at some polls, they look at ALL polls. They have formulas to adjust polls which polls are skewed to favor R’s or D’s. They look at the state polls, county polls, economic data, likely turn out models, key demographics inside key counties inside key swing states. They don’t compete to call who will win an election – boring, too easy, and they’d nearly all being agreeing with each other – they compete on the exact margin on election day campaigns will win by.

Here are the people I’ve found to be the most credible/reliable calling who will win and by how much:

538: 353 Clinton vs 184 Trump. Inside the political prediction world, Nate Silvers has achieved celebrity-like status in 2008. He just released his prediction on 7/1/16.

Sabato: 347 Clinton vs 191 Trump. A professor of PoliSci at University of Virginia, he puts out a free newsletter (I recommend) and calls everything from Presidential races to Governorships to individual Senate and (much more difficult) House races. His prediction as of 6/23/16 (link is live updated).

ElectionProjection.com: 349 Clinton vs 189 Trump. This is a normal guy who blogs but is obsessed with guessing political outcomes accurately. I began following him back in 2004 when he started and he’s a damn good guesser. His prediction as of 7/1/16 (link is live updated):

Princeton Consortium: 330 Clinton vs 208 Trump. This is a highly mathematically based model that the closer you get to election day, the more certainty their model has. PC’s prediction as of 7/1/16:

Outcome based analysis. Every pro is calling a Clinton electorate vote blow out and they differ (not by much) in calling that margin of victory.

Probabilities. It’s good to think of a prediction as the most likely outcome. That said, a more nuanced perspective looks at probabilities to get a sense of likelihood of an outcome. When it comes to betting, upsets happen. The predicts outcomes above are black and white. Here is the grey:

Probabilities of Clinton Winning (taken on 7/1/16):

73% Vegas market makers.

81% FiveThirtyEight’s probability model.

Summary. 6 months before the election, all pros are seeing a likely Clinton blow out (measured by Electorate Votes). While Vegas-like betting markets are putting odds, around 70-ish%, most political pros are 80-ish%.

Betting. When I made my last bet, there was a significant market inefficiency. Currently, the market inefficiency is (=83/73) ~14%. Meh, margin but not enough to make the risk/reward worth it. Last betting cycle the inefficiency was (=53/14) nearly 4x greater.

At it’s most basic, retirement means one thing: passive income. It doesn’t matter if you’re a millionaire or even more, if you don’t have money rolling in each month, passively, you still gotta go to work. Getting clear about exactly what it takes to retire means you’re much more likely to make financial decisions that get you there. There are 4 stages I think make sense to use a framework when thinking about passive income.

Stage 0.5 – PARTIAL RETIREMENT: Imagine your monthly expenses are 5k a month. For many people starting at 0 that might seem like an unattainable number – so they imagine retirement to be binary – either retired or not retired – and as something in the far off future they hope to achieve “someday.” But could you get to 2.5k a month? Because then you could work half as many hours each week and still be covering expenses! How would it feel to work 20 hours a week instead of 40? Pretty damn awesome. Is it irresponsible to not work 40 hours? Hell no. If you’re making the same amount of money you were before and your investments are getting you half way there – now you have choices. Play with all that extra time. Work and use the savings for other things – like Stage 1.

Stage 1: SURVIVAL: Survival means you are at 5k a month in passive income and 5k a month in expenses. You can survive fully on your passive income. This stage is really liberating. You can wake up every day for a month or a year, and do effectively nothing. You can work 40 hours a week, 70 hours a week, or zero. Want a vacation? for 3 months overseas? Done. It’s a game changer. However, you’ll realize you have no margin for error – which in real life, always happens.

STAGE 2: SAFETY: I like to define safety as 2x your monthly expenses. This would mean that half of you income could disappear and you are still good. That’s a large buffer and truth is anything above 1x expenses is safety money. At 2x you have reached a distinct safety level. Lots can go wrong and your life is still good. Market changes, rents go down, unexpected medical expenses, want to help a friend in need, whatever – you can absorb a very, very high degree of unexpectedness. You can even afford to splurge here and there and still feel very safe. This stage sounds amazing because it is. It’s not just retirement, it’s a whole next level of peace and safety. You’re not on the edge of retirement – you have such a buffer that when people worry about changing economic conditions you already planned for it. Hard to imagine financially anything better.

STAGE 3: LUXURY: Passive income is 3x your monthly expenses. At this stage monthly expenses (survival) are covered, a substantial buffer of safety exists Chances are quite high if you’ve achieved this level you’re frugal with your spending and a good investor with your money. When you keep continuing those traits they eventually get you to “luxury.” Where each month even if you went crazy playing / traveling / spending, you’d still end the month with more than you started. This is a stage where you can start asking, what’s something I really want that is a luxury? Not for others, but for you. Love to cook? Nicest kitchen you can think of. Love cars? Which car? Want to pay for family trips? Really this stage is where money starts to border on irrelevant for most expenses. You really start to feel the diminishing utility of extra money at this stage. 1k more when you’re in partial retirement is HUGE. At luxury, it’s nice. It buys nicer plane tickets, an extra trip. Mostly what it buys is that it substantially removes the cost of something from the analysis. It’s more a question of do you really want it. In fact, when you can have anything, then the question is what do you really want (much less what does it cost). What I’ve found with people who reach this level is the opposite of what poor people expect. Instead of buying everything in sight, they actually start to thin a lot of the stuff they already have. A realization that you can have nearly anything gets rid of the “scarcity” of not being able to have something. Quickly stuff just feels like clutter. Instead you want minimal things – but what you have is high quality. Instead of stuff, you buy time. You buy experiences – travel, time with loved ones, freedom from doing things you don’t enjoy, convenience (skipping airport lines, pre-cooked healthy food, etc). At this stage, life at this stage is the least about money.

Most people think of retirement in a binary way – retired or not retired. I think it’s much more helpful to see and experience it as a continuum from partial retirement to survival to safety to luxury.

I would add that while I think these stages are pretty applicable for everyone, the multiplier you use could vary greatly from what I used. If you’re a school teacher in retirement, your income is VERY predictable so 2x income may be greatly excessive for safety. Maybe 25% would qualfy. Luxury might be 50%. The greater your income could vary, the wider the margin of safety you might want is.